28.04.2025

What Is Limiting Crypto Adoption?

Many of us in the crypto space are tech-savvy enthusiasts who understand the implications of blockchain and crypto and how transformative this technology is to various sectors and how it unlocks a new monetization layer for the internet. It's important to realize, however, that concepts we consider common knowledge are often viewed as incomprehensibly complex or even "dark magic" by others. The call for wider adoption has been echoing through the crypto community for years. Yet only a handful of projects have achieved considerable adoption, while others fail to attract non-crypto native users. Adoption can be achieved by onboarding new users into the ecosystem, and they won’t come because we have blobs or a novel consensus. Users simply want to use the technology without thinking about what is going on under the hood. Users will be using applications that empower them, instead of making them feel dumb.

Take ChatGPT as an example: the vast majority of people using it have no idea how neural networks work or even what GPT stands for, but they feel empowered by the possibilities, benefits, and quality of life improvements it presents. Many brilliant people worked relentlessly to abstract away all the complexity to eventually package it with a nice and intuitive user interface for us to enjoy. Crypto is no different; in this article, we'll examine aspects that need more attention to achieve mass adoption.

Infra, Infra, Infra...

For some time now, the topic of discussion amongst founders and people involved in the crypto space has been the overwhelming focus on infrastructure development. Essentially, most new projects have been maximizing metrics such as transactions-per-second, finality, and costs per transaction. Parallel EVMs, Blobs on Ethereum, sharding, alternative consensus algorithms—all contribute to the materialization of cheap, fast, and secure decentralized protocols.

These advancements are significant but are ultimately targeted at and appreciated by seasoned crypto natives, builders, and researchers who actually know the difference between a ZK L2 and an Optimistic L2. To fully appreciate these novel improvements, average users need to educate themselves and be prepared to withstand the hurdles of self-custody, cumbersome UX, and specific crypto jargon, but the user simply does not care and expects the experience to be at least as good as web2. To maximize adoption potential and attract non-tech-savvy users, we should instead aim to hide or abstract away these complexities.

User Experience

It took a while until e-commerce became as big as it is today. For a long time, ordering something online was met with skepticism. Many buyers were cautious when entering their credit card info into a website, and delivery methods were limited. Today, we enjoy instant or next-day delivery of whatever the mind desires in just a few clicks.

In the current highly competitive landscape, every additional click can discourage new users. Even creating an account with an email and password may seem like too much work for an average user, which is why we often use one-click sign-ins via AppleID, Google accounts, or more recently biometrics that further simplify authentication. Simply put, the more intuitive, faster, and more straightforward it is for customers to spend money, the more likely they are to actually spend it. The same applies to blockchain and its plethora of dApps.

We're moving in the right direction with account abstractions, gasless transactions, and new authentication methods. Wallets specifically have often been criticized for being unintuitive and prone to user errors. Most of us probably experienced how chaotic it can be to onboard your non-techy friend into crypto:

Alice: "So this is your wallet. Keep your seed phrase safe. If you lose it, no one can help you recover it!"

Bob: "Okay, I'll take a screenshot and I'm good, right?"

Alice: "No, you should not store it digitally. Write it down and keep it offline!"

Bob: "Hmm, I don't even have a pen right now, but sure."

Alice: "Cool, you can withdraw your ETH from Binance to this address now. What app would you like to try?"

Bob: "Yeah, I really want to buy some dog coins, like the one with the hat."

Alice: "Well, that one is on Solana, so you actually need a different wallet and SOL instead of ETH."

Bob: "Oh, okay. Then some other dog coin that is not on Solana?"

Alice: "There are a lot of them. Do you want something on mainnet or L2s?"

Bob: "What is an L2?"

Alice: "Never mind, let's just buy this token on Base."

Bob: "Cool, so I have the ETH ready. Where can I buy it?"

Alice: "You need to bridge to Base first!"

Bob: "Well, okay..."

Alice: "Now approve the transaction and then submit it."

Bob: "Approve?"

Alice: "Yes, you first need to grant permission..."

Bob: "Okay, I clicked approve already, but it cost money apparently."

Alice: "Yes, every transaction costs something."

Bob: "But you said this is just the approval."

Alice: "Yes, that's also a transaction."

Bob: "Okay, weird. So I did both transactions, but now I don't see the ETH in my wallet anymore."

Alice: "That's because that was only the bridging. You need to switch to Base to see it."

Bob: "Switch to what now? How do I do that?"

Alice: "Just change the network in your wallet. If you don't see it there, just add it using the RPC URL."

Bob: "My wallet has a network? Where do I do that? What is an RPC?

See how confused someone who has never used crypto before can be? The fragmentation of markets across different blockchains and Layer 2 solutions is just the tip of the iceberg that we on Crypto Twitter often call out. That's because this aspect is problematic even for crypto-natives. We already know how bridging works and what a contract address is. But others outside our echo chamber have no idea, and since we're working with real value, they're likely afraid of making mistakes.

Wallets are getting simpler and more intuitive, but there's still a long road ahead. With the recent AI craze, many believe Large Language Models and on-chain agents can effectively replace wallets as we know them. Instead of switching networks, bridging, and approving manually, we envision a future where users simply communicate what they want to do on-chain to an LLM agent using natural language. This agent would find the best path and price for the task and with one click, handle the entire process, essentially acting as your private crypto broker and making DeFi participation even simpler than logging into your online banking account. Once users can use the blockchain and DeFi without having to consider the technicalities or various networks, liquidity pools, or bridges and it just works like magic, that is the 0-1 moment.

Adoption Outside of DeFi

Even though DeFi is the most prevalent application of smart contracts, there are many other useful and novel use cases that sadly have even less adoption. The simplest example is payments. Today, almost everyone has heard of Bitcoin, and many may even hold it. But using Bitcoin for everyday payments isn't easy. You either use the Lightning Network, which has its own downsides, or you pay a high transaction fee and wait 20 minutes for confirmation, assuming you can find a shop that accepts Bitcoin.

However, most shops accept card payments using VISA or MasterCard. This is where crypto cards come in, essentially debit cards you can top up with your crypto tokens, allowing you to spend your crypto gains within minutes. Our favorite solution at Moonlanding is Holyheld: a simple and intuitive UI which can even feel way too simple for crypto-natives, multi-network support, card top-up within 5 minutes, Apple Pay compatibility, and even cashback. It simply works, unlike competitors who often add unsustainable perks or yields to attract users.

A major topic even years back was the decentralized storage, pioneered by Filecoin. After years of development, even crypto natives opt for centralized storage solutions.

Developers build decentralized applications on permissionless blockchains with a high degree of decentralization but then deploy their frontend application to AWS. They're not forced to use centralized solutions; centralized options are simply easier to work with.

Glitter Protocol is currently working on streamlining the process of deploying frontends to decentralized storage while also allowing verification of website integrity. Additionally, with evolving AI-generated media, we need ways to verify whether content was created by humans or diffusion models. The blockchain is the perfect technology for this authentication challenge.

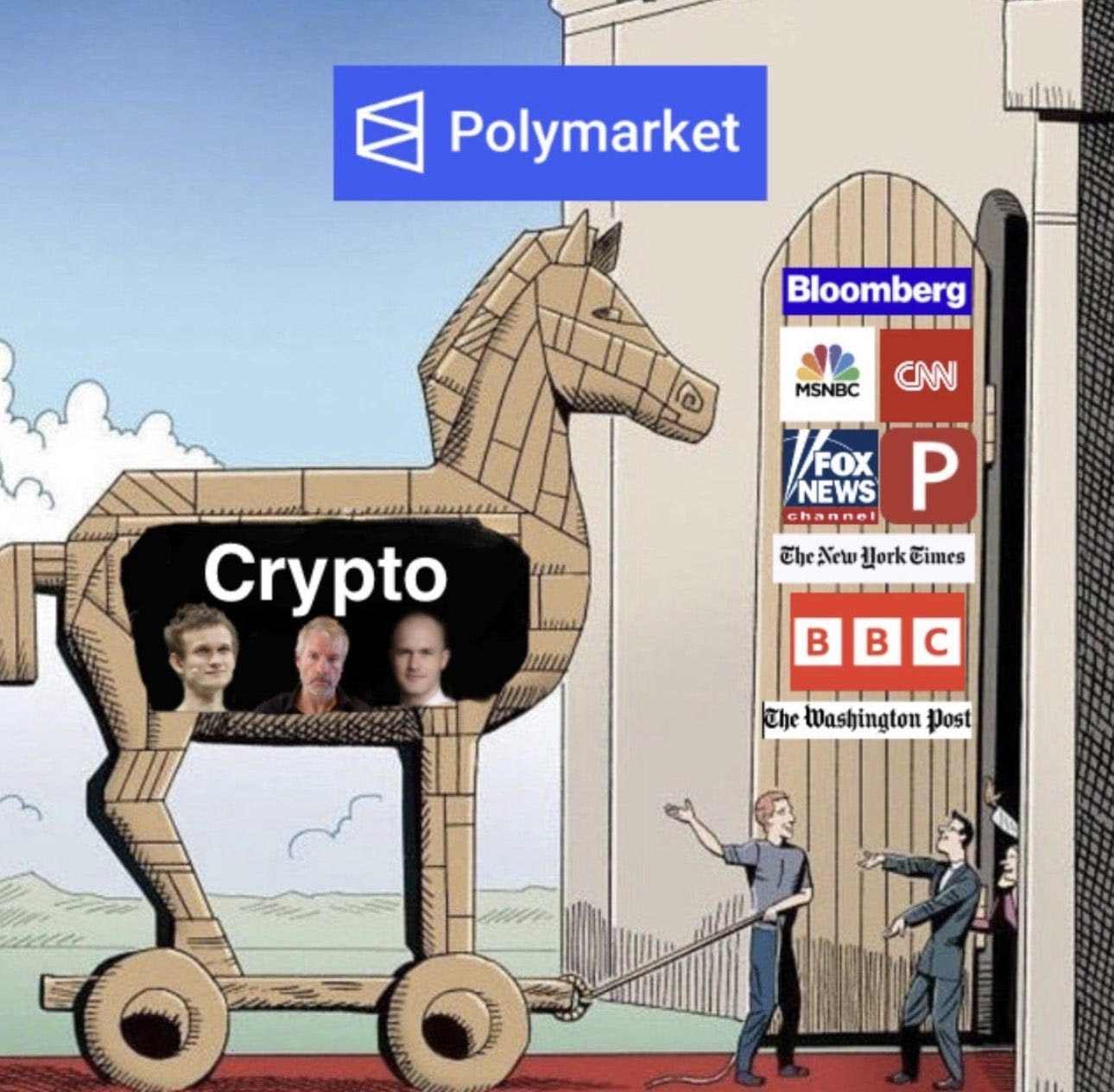

Trojan Horsing Crypto into the Mainstream

In our last article, we discussed the double-edged sword of crypto: token value. Crypto is often portrayed negatively, especially when tokens drop 90% or users get rug-pulled and scammed. This criticism particularly applies to NFTs, even at their peak. However, NFTs have great potential beyond art or profile pictures; they could be applied to event tickets, transportation passes, diplomas, loyalty cards, licenses, and much more.

The hard truth is that when average customers see "NFT," they instantly recall negative associations and turn to other solutions. To tackle this, we need to integrate such technologies in ways that users don't realize they're using blockchain under the hood. Instead of prompting users to create wallets, solutions like Privy can abstract the complexity away and use familiar verification methods like email or passkeys.

A great example of successfully "Trojan Horsing" crypto into mainstream adoption is Polymarket. During the last presidential election, it proved its usefulness as a truth well when, a week prior to the election, its predictions correctly forecasted the outcome in each state. Referenced by mainstream media outlets, it showcased the accuracy of crowd wisdom over traditional exit polls or surveys.

Conclusion

Mass adoption of blockchain technology requires us to look beyond pure technical improvements and focus more on user experience, practical applications, and seamless integration. By abstracting away complexity, focusing on real-world use cases, and quietly embedding blockchain functionality into familiar interfaces, we can finally bridge the gap between crypto enthusiasts and mainstream users. The future of adoption isn't about getting users to understand blockchain, it's about making blockchain understand developers, builders, and users.